Getting The Hsmb Advisory Llc To Work

Hsmb Advisory Llc Fundamentals Explained

Table of ContentsHsmb Advisory Llc Can Be Fun For EveryoneWhat Does Hsmb Advisory Llc Mean?Not known Facts About Hsmb Advisory LlcWhat Does Hsmb Advisory Llc Do?

Life insurance policy is especially crucial if your family members is reliant on your wage. Sector specialists suggest a policy that pays out 10 times your yearly income. These may include home loan payments, exceptional financings, credit history card financial obligation, tax obligations, child treatment, and future university prices.Bureau of Labor Stats, both spouses worked and brought in earnings in 48. They would certainly be likely to experience economic difficulty as an outcome of one of their wage earners' fatalities., or exclusive insurance policy you get for yourself and your family members by contacting health and wellness insurance policy business directly or going with a health insurance representative.

2% of the American population was without insurance coverage in 2021, the Centers for Condition Control (CDC) reported in its National Facility for Health Data. Greater than 60% obtained their coverage through a company or in the private insurance policy marketplace while the rest were covered by government-subsidized programs including Medicare and Medicaid, experts' benefits programs, and the federal industry established under the Affordable Treatment Act.

The Only Guide to Hsmb Advisory Llc

If your earnings is low, you may be one of the 80 million Americans that are eligible for Medicaid.

According to the Social Protection Management, one in four workers getting in the labor force will certainly become handicapped prior to they reach the age of retirement. While wellness insurance coverage pays for hospitalization and clinical bills, you are often strained with all of the expenses that your income had covered.

Many plans pay 40% to 70% of your earnings. The price of handicap insurance coverage is based on several factors, consisting of age, way of life, and health.

Many strategies call for a three-month waiting duration before the protection kicks in, offer an optimum of three years' well worth of insurance coverage, and have significant policy exemptions. Below are your options when purchasing auto insurance policy: Obligation coverage: Pays for property damages and injuries you create to others if you're at fault for a mishap and likewise covers lawsuits prices and judgments or negotiations if you're taken legal action against since of an auto accident.

Comprehensive insurance coverage covers theft and damages to your cars and truck as a result of floodings, hail storm, fire, vandalism, falling things, and pet strikes. When you finance your vehicle or lease an auto, this sort of insurance coverage is mandatory. Uninsured/underinsured driver (UM) protection: If a without insurance or underinsured vehicle driver strikes your car, this insurance coverage pays for you and your guest's clinical costs and may likewise make up lost revenue or make up for pain and suffering.

Company insurance coverage is frequently the ideal alternative, however if that is not available, get quotes from several providers as many provide discount rates if you acquire more than one kind of protection. (http://go.bubbl.us/dfc735/905b?/HSMB-Advisory-LLC)

Some Of Hsmb Advisory Llc

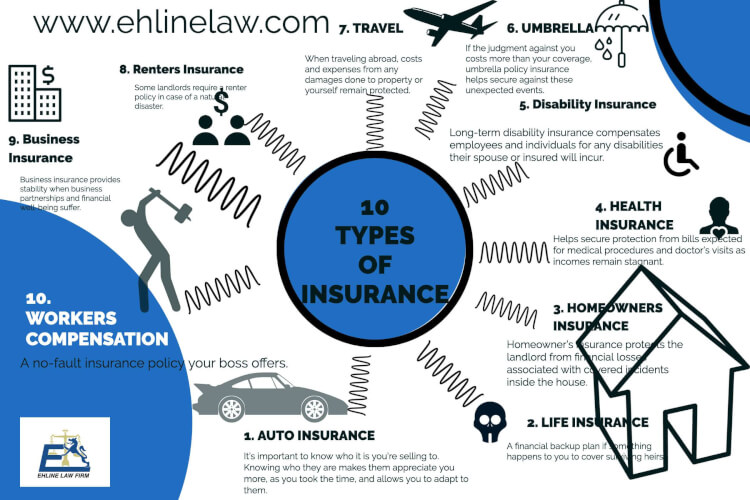

In between medical insurance, life insurance policy, disability, responsibility, long-lasting, and also laptop insurance coverage, the job of covering yourselfand considering the limitless opportunities of what can take place in lifecan feel overwhelming. As soon as you comprehend the fundamentals and make certain you're effectively covered, insurance coverage can enhance financial self-confidence and wellness. Below are the most vital sorts of insurance policy you need and what they do, plus a couple tips to stay clear of overinsuring.

Different states have various regulations, however you can expect wellness insurance policy (which lots of people get through their employer), vehicle insurance coverage (if you have or drive a vehicle), and homeowners insurance (if you own property) to be on the list (https://swaently-paay-truiery.yolasite.com/). Obligatory sorts of insurance coverage can alter, so inspect up on the current laws every now and then, particularly prior to you renew your policies